Building a diverse investment portfolio is essential for managing risk and maximizing returns over the long term. Here are several investment strategies to help you achieve diversity in your portfolio:

Asset Allocation: Allocate your investments across different asset classes such as stocks, bonds, real estate, and commodities. Each asset class has unique risk and return characteristics, so spreading your investments across them can help reduce overall portfolio risk.

Diversification within Asset Classes: Within each asset class, diversify further. For example, in stocks, invest across different industries, sectors, and geographical regions. Similarly, in bonds, consider varying durations, credit qualities, and issuers.

Passive Index Investing: Utilize low-cost index funds or exchange-traded funds (ETFs) to gain exposure to broad market indexes. These funds provide instant diversification across hundreds or thousands of securities within a specific asset class.

Active Fund Management: Consider actively managed mutual funds or ETFs that aim to outperform the market. Look for funds with strong track records and experienced fund managers who employ rigorous research and investment strategies.

International Diversification: Invest in international markets to diversify away from domestic risks. This can involve investing directly in foreign stocks or using international mutual funds or ETFs.

Alternative Investments: Incorporate alternative investments such as real estate investment trusts (REITs), commodities, private equity, or hedge funds. These assets often have low correlations with traditional stocks and bonds, providing additional diversification benefits.

Risk Management: Implement risk management techniques such as stop-loss orders, options strategies, or asset allocation rebalancing to mitigate downside risk and protect gains during market downturns.

Consideration of Correlations: Understand the correlations between different assets in your portfolio. Aim to include assets with low or negative correlations to each other, as they can help offset losses during market volatility.

Regular Portfolio Rebalancing: Periodically rebalance your portfolio to maintain target asset allocations. Rebalancing ensures that your portfolio remains diversified and aligned with your investment objectives over time.

Tax Efficiency: Consider the tax implications of your investment decisions. Utilize tax-advantaged accounts such as IRAs and 401(k)s and be mindful of the tax consequences of buying and selling investments.

Long-Term Perspective: Maintain a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations. Diversification is most effective when viewed as a long-term strategy.

By incorporating these strategies into your investment approach, you can build a well-diversified portfolio that is better positioned to weather market uncertainties and achieve your financial goals over time.

Investment strategies.

Investment strategies.

Diversification is key to a robust investment strategy. Allocate your capital across various asset classes like stocks, bonds, real estate, and commodities to spread risk. Within each asset class, further diversify by investing in different industries, sectors, and geographical regions. Consider passive index funds for broad market exposure or actively managed funds with strong track records. International diversification helps mitigate domestic risks, while alternative investments like REITs or private equity offer additional diversification benefits. Implement risk management techniques such as stop-loss orders and regular portfolio rebalancing to protect gains and mitigate downside risk. Understand correlations between assets and aim for low or negative correlations to offset losses during market volatility. Tax-efficient investing in vehicles like IRAs and 401(k)s can enhance returns. Maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. By following these strategies, you can build a diversified investment portfolio positioned for long-term growth and stability.

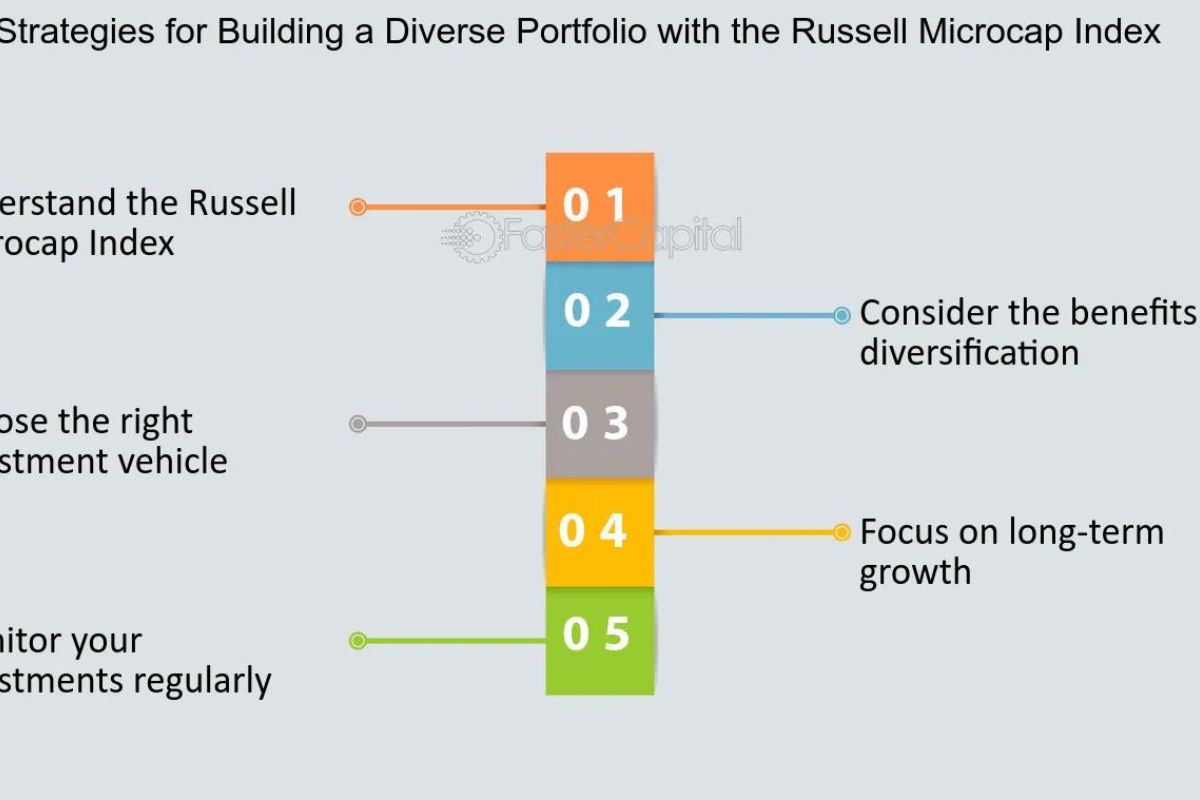

Strategies for Building a Diverse Portfolio with the Russell Microcap Index.

Building a diverse portfolio with the Russell Microcap Index involves several strategies tailored to the characteristics of microcap stocks. First, allocate a portion of your portfolio to the Russell Microcap Index to gain exposure to a broad range of small and microcap companies. These companies often have high growth potential but also carry higher risk, so diversification is crucial.

Within the Russell Microcap Index, diversify across different sectors and industries to spread risk and capture opportunities across various segments of the economy. Consider using index funds or ETFs tracking the Russell Microcap Index for cost-effective exposure.

Additionally, conduct thorough research and due diligence on individual microcap stocks to identify promising investment

opportunities. Look for companies with strong fundamentals, competitive advantages, and growth potential.

Regularly review and rebalance your portfolio to maintain diversification targets and adjust your holdings based on changing market conditions and investment opportunities.

Finally, consider complementing your holdings in the Russell Microcap Index with investments in other asset classes to further diversify your portfolio. This might include allocations to larger-cap stocks, bonds, real estate, and alternative investments.

By employing these strategies, you can effectively build a diversified portfolio with exposure to the Russell Microcap Index while managing risk and maximizing long-term returns.

The Benefits of Investing in Microcap Stocks.

Investing in microcap stocks offers several potential benefits for investors willing to tolerate higher risk in pursuit of greater returns. Firstly, microcap stocks often have substantial growth potential due to their small size and early-stage development. These companies may operate in niche markets or possess innovative technologies, offering the opportunity for significant appreciation if they succeed.

Moreover, microcap stocks can be less efficiently priced than larger companies, presenting opportunities for astute investors to identify undervalued gems before they are discovered by the broader market. This inefficiency can result from lower analyst coverage and fewer institutional investors, allowing diligent investors to uncover hidden gems through thorough research and analysis.

Additionally, microcap stocks tend to be less correlated with broader market movements, providing diversification benefits within a portfolio. Their performance may be driven more by company-specific factors rather than macroeconomic trends, reducing overall portfolio risk.

Furthermore, investing in microcap stocks allows investors to participate in the growth of smaller companies that may eventually become mid-cap or large-cap stocks. Early investment in successful microcap companies can lead to substantial gains over the long term as these firms grow and mature.

Overall, while investing in microcap stocks carries higher risk due to their small size and volatility, it also offers the potential for significant rewards for investors with a high tolerance for risk and a long-term investment horizon.

How the Russell Microcap Index Works?

The Russell Microcap Index tracks the performance of the smallest 1,000 companies in the Russell 3000 Index, representing the microcap segment of the U.S. equity market. Constituent companies are selected based on market capitalization and undergo annual reconstitution. The index provides exposure to small, publicly traded companies, offering investors insight into the performance of this segment of the market. It serves as a benchmark for microcap stock performance and is commonly used by investors and fund managers to gauge the performance of their microcap investments relative to the broader market.

Top Companies in the Russell Microcap Index .

1. The Andersons, Inc. (ANDE) – A diversified company operating in agriculture, ethanol, railcar leasing, and food ingredients.

2. Mistras Group, Inc. (MG) – Provides technology-enabled asset protection solutions, including non-destructive testing, inspection, and engineering services.

3. Hill International, Inc. (HIL) – A global construction consulting firm specializing in project management, construction claims, and advisory services.

4. Chesapeake Utilities Corporation. (CPK) – A diversified energy company engaged in natural gas distribution, transmission, and marketing, as well as propane distribution and related services.

5. Denny’s Corporation .(DENN) – A restaurant chain known for its diner-style food offerings, operating primarily in the United States.

These companies represent a diverse range of industries and sectors within the microcap segment of the market.p Companies in the Russell Microcap Index

Risks and Challenges of Investing in Microcap Stocks.

Investing in microcap stocks carries inherent risks and challenges. These include:

High volatility: Microcap stocks can experience sharp price fluctuations due to their small size and limited liquidity.

Lack of information: Limited public information and analyst coverage make it challenging to assess the fundamentals and prospects of microcap companies accurately.

Susceptibility to manipulation: Microcap stocks are more prone to manipulation and fraudulent schemes.

Liquidity concerns: Limited trading volume can make it difficult to buy or sell large positions without impacting the stock price.

Higher risk of failure: Many microcap companies are early-stage or unproven businesses, increasing the risk of investment losses.

Strategies for Building a Diverse Portfolio with the Russell Microcap Index.

Building a diverse portfolio with the Russell Microcap Index involves several key strategies. Firstly, allocate a portion of your portfolio to the index to gain exposure to a broad range of small-cap companies. This provides diversification across various industries and sectors within the microcap segment. Additionally, consider complementing your holdings in the index with investments in other asset classes such as large-cap stocks, bonds, real estate, and alternative investments. Diversifying across different asset classes helps spread risk and reduces the impact of volatility in any single asset class.

Furthermore, within the Russell Microcap Index, diversify across individual stocks to mitigate company-specific risk. Conduct thorough research and due diligence on individual companies to identify promising investment opportunities. Regularly review and rebalance your portfolio to maintain diversification targets and adjust your holdings based on changing market conditions. By following these strategies, you can effectively build a diversified portfolio with exposure to the Russell Microcap Index while managing risk and maximizing long-term returns.

How to Invest in the Russell Microcap Index?

To invest in the Russell Microcap Index, you can purchase exchange-traded funds (ETFs) or mutual funds that track the index. These funds are readily available through most brokerage platforms. Simply open a brokerage account, deposit funds, and search for ETFs or mutual funds with exposure to the Russell Microcap Index. Once you’ve identified a suitable fund, place a buy order for the desired amount of shares. Alternatively, some investment firms offer managed portfolios that include exposure to the Russell Microcap Index. Ensure to review the fund’s prospectus, fees, and historical performance before investing to align with your investment objectives and risk tolerance.

Why the Russell Microcap Index Should be Part of Your Investment Strategy?

The Russell Microcap Index should be part of your investment strategy for several reasons. Firstly, microcap stocks often exhibit substantial growth potential, offering the opportunity for significant appreciation over time. By including the Russell Microcap Index in your portfolio, you gain exposure to this segment of the market and can potentially capture the growth of smaller, high-potential companies.

Moreover, microcap stocks tend to be less correlated with broader market movements, providing diversification benefits. Adding the Russell Microcap Index to your investment strategy can help reduce overall portfolio risk by spreading investments across different market segments with varying risk profiles.

Additionally, investing in the Russell Microcap Index allows you to participate in the growth of smaller companies that may eventually become mid-cap or large-cap stocks. Early investment in successful microcap companies can lead to substantial gains over the long term as these firms grow and mature.

Overall, incorporating the Russell Microcap Index into your investment strategy can enhance diversification, capture potential growth opportunities, and contribute to long-term portfolio performance.

Frequently Asked Question.

What are the investment strategies in portfolio management?

Investment strategies in portfolio management include asset allocation, diversification, active or passive management, risk management techniques, regular rebalancing, and consideration of factors like tax efficiency and investment goals. These strategies aim to optimize risk-adjusted returns and align investments with the investor’s objectives and risk tolerance.

What are the strategies for building a portfolio?

Strategies for building a portfolio involve asset allocation across various asset classes, such as stocks, bonds, and real estate, diversification within each asset class, regular portfolio rebalancing, risk management techniques, consideration of investment goals and time horizon, and staying informed about market trends and economic conditions.